Resulting Trust

- Resulting trusts return the beneficial interest to the settlor of a property where the legal ownership has been transferred, but it can be implied that it (or part of it) is being held by the legal owner on behalf of the settlor (for example, where a party has contributed funds towards the purchase but is not named on the title deeds).

- It is an 'implied' trust rather than an express trust, which would be created deliberately and usually in writing.

- Any contributions to the utility bills or mortgage repayment create a different type of trust.

- You can prove the trust by showing that you've contributed financially to the purchase or disprove it with specific documentation.

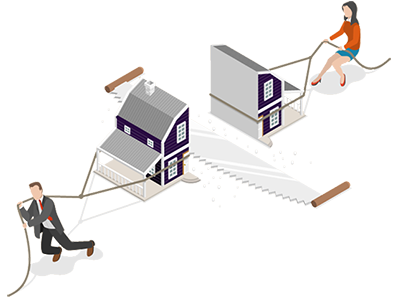

- This type of trust usually involves a dispute over how to divide the shares after a breakdown in the relationship between the legal and beneficial owner(s), and can be avoided if both parties set their intentions in writing from the start.

- If you are holding a house in trust, you are obligated to maintain it to a reasonable standard.

What is the meaning of resulting trust?

This type of trust arises when the property ‘results’ back to the original settlor; in other words, the beneficial ownership in a property is reflected in how the property was originally purchased.

The cases of Dyer v Dyer (1788) and Tinsley v Milligan [1994] show the presumption of ownership that a person who contributed towards a share, or all, of the purchase price of a property would be entitled to the corresponding proportion of the beneficial interest in the property, by way of an implied trust.

If someone is jointly funding the purchase of a property with no intention to hold a beneficial interest, you must confirm this in an express document such as a gift letter or Deed of Trust. Otherwise, jointly funding the purchase may create a resulting trust, entitling the parties to beneficial interest relative to their original investment.

Even though you may be the sole legal owner of the property, the beneficial interest in the property (the full equity, which includes any capital gains made when the property is sold) could be shared with the person who helped buy the property with you.

When will a resulting trust arise? | |

|---|---|

When will a resulting trust arise? In all of the following cases, there is no presumption that the money paid is a gift, and it is presumed the money is to be repaid and the property held on trust for them:

| There are exclusions (subject to circumstances) to a presumption of trust where it is presumed the money paid is a gift instead, which include:

|

In all cases your solicitor should confirm with you if any money from a third party being used towards the purchase price is a gift or a loan during the conveyancing; to satisfy both their obligations towards you and the mortgage lender.

The clear inequality between husbands and wives transferring property to their spouse is referred to as the presumption of advancement, and one may have assumed it would be abolished following the introduction of the Equality Act (2010). In practice, the presumption of advancement still stands in many cases.

This approach is no longer applied to cases involving family homes; the court is not bound to deal with the matter on the strict basis of the trust resulting from the cash contribution to the purchase price and is free to attribute to the parties an intention to share the beneficial interest in some different proportions: Midland Bank v Cooke [1995].

Bare, Resulting, and Constructive Trusts

The 3 types of trust that are used to define the beneficial ownership of property are:

- Express Trust or a Bare Trust - where joint owners of property set out their intentions and the beneficial interest in the property at the outset (or by mutual agreement during their ownership). This type of trust can either be a Declaration of Trust or a Deed of Trust.

- Resulting Trust - where no Express or Bare Trust has been drafted and the contribution towards the original purchase price of the property is used to work out the beneficial share in the property. This is not applicable if you have set out your beneficial interest within an Express Trust.

- Constructive Trust - relates to the consequence of the conduct of the party towards the property such as contributing towards mortgage repayments after purchase and renovation works that add value to the property. This is not applicable if you have set out your intentions within an Express Trust.

What is an example of resulting trust?

Dave is the sole legal owner of a property he purchased in 1980 for £200,000. Dave's partner, Jane, invested £20,000 into the purchase price, Dave invested £20,000 and Dave got a mortgage for the remaining £160,000.

In 1990 when Dave comes to sell the property, Dave and Jane aren't together but Jane is expecting to get paid money from the sale. During the whole period, Dave paid all of the mortgage repayments and Jane didn’t pay anything else towards the property.

Dave tells Jane she is due nothing when he sells the property.

Conclusion: Dave is incorrect. As Dave and Jane didn't draft an agreement confirming the £20,000 paid by Jane was a gift or that it wasn't to be repaid to her, then there is an automatic presumption that the money paid by Jane was being held on Trust by Dave and was to be repaid to Jane in the future, thus giving rise to a resulting trust.

Now Dave is selling, Jane will be due a share of the beneficial interest in the property. The trust means Jane is due shares proportional to her contribution to the purchase price and mortgage payments. If Dave doesn't accept this, then Jane will need the help of a specialist trust solicitor to help enforce her legal right to the beneficial interest in the property.

Dave will also need to instruct a solicitor as he could argue that as he paid all of the mortgage repayments, there is also a Constructive Trust, which could affect the beneficial ownership split between Dave and Jane.

Dave and Jane's disagreement on who owns the beneficial interest in the sale of the property could have been avoided if they both agreed at the outset what their intentions were within a legal agreement. Dave thought the money was a gift, however, without a gift letter he is unable to prove this.

Book a FREE* 15-minute meeting with a property dispute specialist who will listen to your issue and suggest ways forward, including the costs, with no obligation to use our services after the free meeting.

- What are you due on sale?

- How to sell where one person doesn't want to.

- Mediation and Settlement Agreements.

- Applications to court, including Declaratory Orders, Regulatory Orders, Occupational Rent.

Are there two classifications of resulting trust?

In 1974, Megarry J attempted to classify resulting trusts into two types:

Presumptive resulting trusts

When Party A conveyances property to Party B, or makes a monetary contribution to the purchase of Party B's property, but Party A's intention is unclear (there is no written record or evidence of the original intention), the law presumes a resulting trust for Party A; unless Party A is the parent or husband of Party B, or acting in loco parentis.

Presumptive resulting trusts are rebuttable.

Automatic resulting trusts

These take automatic effect by operation of law, usually when a settlor (Party A) places property into trust for a third party (Party B), but they haven't set the trust up properly; for example, the beneficiaries can't be defined, or the trust objectives aren't possible or relevant at the time of transfer. In these cases, the assets of the trust would 'result' back to Party A, or if Party A has died, to their estate.

Some people argue that automatic resulting trusts like this only arise from an express trust, where the trustee has a legal right to hold the property on trust for the settlor. It is harder to rebut automatic resulting trusts as there is ambiguity in the circumstances where an automatic trust arises, either from a "presumed intention to create a trust in favour of the settlor" or from a "lack of intention to benefit the recipient".

How do you prove a resulting trust?

To prove a presumptive trust, you’ll need to demonstrate that you contributed towards the original purchase price of the property. Let’s look at what constitutes the purchase price of the property.

A key principle to understand if there is a trust is that it is presumed, outside of certain relationships, that any money paid to a third party is never a gift and is always due to be paid back.

This means if someone pays money to buy a property and receives no consideration in return, then it is presumed that they have intended to retain an equitable interest in the property being purchased (ie they are going to get something back from the sale of the property in the future). The person buying the property will, therefore, hold the property in trust for them.

How do you rebut the presumption of resulting trust?

This trust is only presumed and, as such, can be rebutted if evidence can be provided to prove that the parties intended to gift the money. Examples include:

- Evidence the money was a gift, such as a gifted deposit letter.

- Evidence the money was a loan, such as a loan agreement or a promissory note.

Once again, this evidence would normally be obtained by your solicitor during the purchase of the property when they complete their due diligence of source of funds and to satisfy their obligations towards your mortgage lender. If you are getting a mortgage and are receiving money from a third party, then your mortgage lender will require you to confirm if the money used to buy the property is a gift or a loan.

Why do mortgage lenders need to know if the money is a gift or a loan?

The simple answer is that mortgage lenders do not want any party to have a beneficial interest in the property unless they're bound by their mortgage terms. This is why your solicitor will need evidence to prove whether the money you are receiving is:

- A gift, which means the payer has no legal rights to get the money repaid. You should note that some mortgage lenders only allow gifts from parents. This means if your gift is from a friend or other family member, you may need to find a mortgage lender that allows for this and does not treat the apparent gift as a loan.

- A loan, with a loan agreement drafted. Once again, you may struggle with this route as many mortgage lenders do not allow for a loan, and those that do will normally require the loan to be registered as a second charge behind their own first charge (i.e. in the event of repossession, any proceeds from a subsequent sale will be firstly used to repay the lender).

As you can see from the above, without setting out your intentions for the property in an Express Trust, your intentions may not follow your original plan - something that can cause a challenge if the relationship between you and a joint owner changes (such as a breakdown in a relationship).

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.