Help to Buy Repayment Calculator

The Help to Buy scheme closed in 2023 after helping first-time buyers and home movers onto the property ladder. However, the Help to Buy Wales scheme was extended to March 2025. Many of these homeowners are now looking to repay some or all of their equity loan, especially since the interest rate increases after 5 years.

There has been much speculation about its potential return but no official announcements.

How the Help to Buy interest rate works

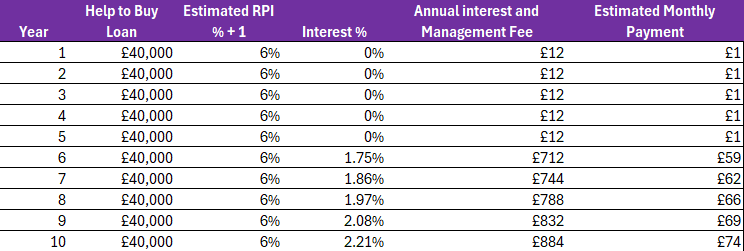

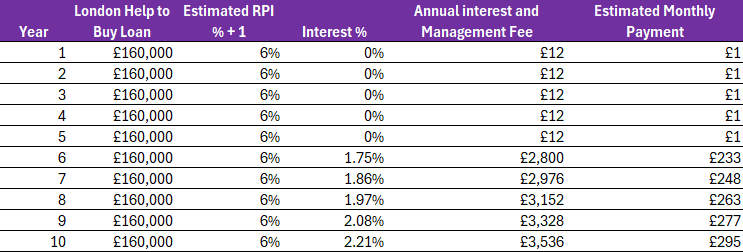

There are no equity loan costs or fees on the government money you borrowed for the first five years. Starting in the sixth year, you'll pay a fee of 1.75% of the total loan amount.

This fee will go up each year based on inflation, which is calculated using the Retail Price Index (RPI) + 1% as set by the Office of National Statistics.

This is how your help to buy mortgage payments and interest rate is calculated:

Year 1-5 | 0% |

Year 6 | 1.75% |

From Year 7 | 1.75% + RPI + 1% |

Interest and management fees on a £40,000 equity loan (non-London)

Interest and management fees on a £160,000 equity loan (London)

Floating vs fixed

Most Help to Buy mortgages have an initial fixed rate, which means the interest rate won't change for a specific period. After that, the mortgage rate becomes variable and can go up or down.

SAM's Help to Buy interest repayment calculator

Make sense of your Help to Buy monthly interest payments

Our Help to Buy interest repayment calculator estimates your monthly interest payments. Enter the equity loan percentage, current market value, and how many years you've owned the property to get results. Keep in mind that this is just an approximation.

Help to Buy Repayments Calculator

SAM's Help to Buy mortgage repayment calculator

Your Help to Buy mortgage payments differ from the Help to Buy equity loan repayments. You can use our calculator above to estimate the interest repayments, but we also have a mortgage payments calculator available. You might wish to remortgage to consolidate into one monthly payment.

Has it been 5 years since you secured your Help to Buy loan?

Your 5-year interest-free period for the Help to Buy equity loan is over. You'll now start paying interest on the amount you borrowed. Use our calculator above to see how much this will add to your monthly payments.

How can you redeem your Help to Buy loan?

Can I pay off my Help to Buy loan by remortgaging?

You can start the Help to Buy Redeem process without selling. This process covers if you don't sell the property but do settle the equity loan in full (normally through a remortgage, further loan, or personal savings).

- 1Mortgage Valuation - Obtain a RICS Valuation, we have valuers available this week*, and reports are sent in 5 working days.

- 2Application - Submit your Help to Buy Application Form, including your RICS valuation and pay your admin fee.

- 3ID - Provide your ID and Source of Funds.

- 4Mortgage offer - You progress your mortgage application, and once approved, the mortgage offer/further advance letter is sent to your solicitor. This can take 10 to 20 working days.

- 5Source of Funds Certificate - Your Solicitor reviews the offer and, if satisfied, submits a Certificate of Source of Funds to Help to Buy within 3 working days.

- 6Redemption Statement - Help to Buy issue a Redemption Statement within 10 to 15 working days. You can chase them to speed this along.

- 7Completion Statement - Your solicitor prepares the file for completion and sends their legal undertaking to Help to Buy, requesting their Authority to Complete.

- 8Authority to Complete - Help to Buy reply after 15 working days. You can chase them to speed this along.

- 9Completion - Your solicitor draws down the new mortgage or further advance and pays off the loan and old mortgage if applicable. If repaid in full, an e-DS1 is submitted to the Land Registry to remove the charge from the title. If a partial repayment is made, a memorandum of staircasing is issued confirming the amount remaining on the Help to Buy equity loan.

Can I sell my house if I have Help to Buy?

You can sell the property over which the loan is secured. However, it is important to remember that you must repay the equity loan in full regardless of whether the property has gone up or down in value. The loan repayable is calculated as the loan percentage of either the current market value of your home or the agreed sale price (whichever is higher).

To sell your property, you will need to:

- 1Mortgage Valuation - Obtain a RICS Valuation, we have valuers available this week*, and reports are sent in 5 working days.

- 2Application - Submit your Help to Buy Application Form, including your RICS valuation and pay your admin fee.

- 3ID - Provide your ID.

- 4Redemption Statement - Help to Buy issue a Redemption Statement within 10 to 15 working days - faster if you chase them.

- 5Completion Statement - Your solicitor prepares the file for completion and sends their legal undertaking to Help to Buy, requesting their Authority to Complete.

- 6Authority to Complete - Help to Buy reply after 15 working days - faster if you chase them.

- 7Completion - On the completion of the sale, your solicitor repays the loan in full from the proceeds. An e-DS1 is submitted to the Land Registry to remove the charge from the title.

Your loan at the outset was 20% of the purchase price of £250,000 then the loan value at that time was £50,000. When you sell you agree a sale price of £300,000 which means the value to repay the loan is 20% of £300,000 which is £60,000. Read more - How to Sell a Help to Buy Property.

Help to Buy Staircasing allows you to partially redeem your Help to Buy equity loan while owning more equity in your home. Read more - How do I partially staircase a Help to Buy?.

- 1Mortgage Valuation - Obtain a RICS Valuation.

- 2Application - Submit your Help to Buy Application Form, including your RICS valuation and pay your admin fee.

- 3Provide your ID & source of funds.

- 4Source of Funds Certificate - Your Solicitor reviews the source of refunds within 5 working days and often requests further evidence. Once satisfied, the solicitor submits a Certificate of Source of Funds to Help to Buy, within 3 working days.

- 5Redemption Statement - Help to Buy issue a Redemption Statement within 10 to 15 working days - faster if you chase them.

- 6Completion Statement - Your solicitor prepares the file for completion and sends their legal undertaking to Help to Buy, requesting their Authority to Complete.

- 7Payment - At this stage, you transfer the full amount for the loan repayment into the solicitor's account, who will hold it until completion day.

- 8Authority to Complete - Help to Buy reply after 15 working days - faster if you chase them.

- 9Completion - Your solicitor pays in the completion monies. If a partial repayment is made, a memorandum of staircasing is issued confirming the amount remaining on the Help to Buy equity loan.

Your loan at the outset was 20% of the purchase price of £250,000, then the loan value at that time was £50,000. When you staircase, you agree on a property valuation of £300,000 and to staircase 10%, which means the value to repay the loan is 10% of £300,000, which is £30,000.

What are the requirements to staircase a Help to Buy equity loan?

- The minimum amount you can staircase at one time is 10% (of the total market value of the property at the time you staircase);

- The above requirement means that when the lenders’ equity in your property is less than 20%, you can only repay the loan in full;

- You may only staircase in multiples of 10%, that is 10%, 20%, 30% etc; and

- You cannot staircase if there are any arrears of interest payments and/or management fees on your mortgage account. Any arrears must be cleared, before a staircase transaction can proceed.

Thinking about moving home?

Read our article on whether you can transfer your help to buy loan, next.

Help to Buy valuations

If you have an existing Help to Buy loan on your home, you will need a Help to Buy RICS valuation when repaying any of the loan; whether by cash, remortgage or sale of the property.

If you're selling, you'll need a current market valuation before paying off the whole loan from the sale proceeds; if you're just getting a new mortgage without paying off the loan, you don't need a valuation.

It is a current market valuation, but it must meet additional criteria to comply with the Help to Buy administrator's requirements.

- The Help to Buy surveyor must be registered with the recognised qualification of RICS.

- The Help to Buy surveyor must be independent of an estate agent.

- The report must be on headed paper, signed by the RICS surveyor and addressed to Help to Buy customer services.

- The Help to Buy surveyor MUST provide at least 3 comparable properties and sale prices.

- The comparables provided must be like for like in terms of property type, size, and age and within a 2-mile radius of the property that is being inspected.

- The Help to Buy surveyor must not be related or known to you.

- The Help to Buy surveyor must inspect the interior of the property and provide a full valuation report.

SAM's surveyors are all RICS-accredited and Help to Buy compliant.

Need a Help to Buy valuation survey?

Our current market valuation cost starts at £250 EXC VAT. Get a tailored quote for your Help to Buy Valuation from our nationwide panel of experienced, local RICS Valuers.

RICS Surveyors | Fixed Fees | Same week availability | Access arranged

Jack is our resident Content Writer with a wealth of experience in Marketing, Content, and Film. If you need anything written or proof-read at a rapid speed and high quality, he's your guy.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.