When you die without a will your estate (property, possessions and money) is shared out according to certain rules - and if no one falls under the rules, then the estate goes to the Crown. These are called the intestacy rules and anyone who dies without a will is called an intestate person.

We handle the complete service of administering the estate including application for

Grant of Representation, payment of Inheritance Tax due, collection of the estate's assets, conveyancing for the sale, payment of any debts/unpaid bills and final distribution to the beneficiaries.

What about intestacy rules for Married couples and civil partners?

In order to inherit under the Intestacy Rules, you must still be married to an intestate person at the point of their death. If you are divorced then you do not inherit anything from your ex-partner. It is important to note that although divorce proceedings may be under way, the intestate person's partner will still inherit until the divorce is finalised by the issuing of the decree absolute.

In cases where you are married and have no children, then the entirety of the estate of the intestate person will pass to their spouse. If there are children or Grand-children related to the intestate person and the net assets of the estate are less than £250,000, then the surviving spouse inherits the entire estate. If the net assets of the estate are over £250,000, the surviving spouse inherits:

- all personal possessions

- the first £250,000

The rest of the estate is divided in half; half goes to the surviving spouse and the remainder shared equally between the children or the Grandchildren.

The interesting part is that the surviving spouse is only entitled to the interest on their half of the capital (not of the £250k, but anything on top of this which is split) during their lifetime so that once they die, the half of the capital is divided equally between the children or Grandchildren.

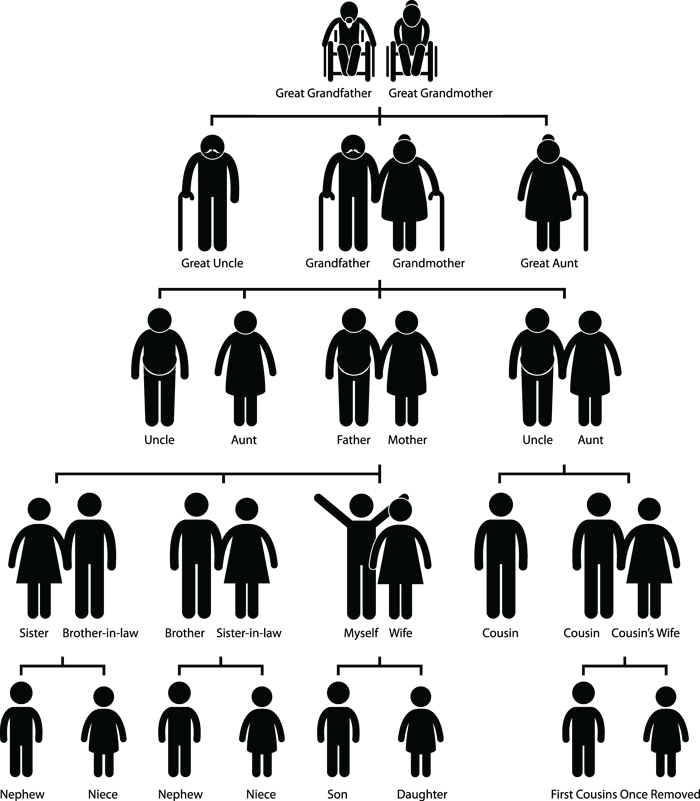

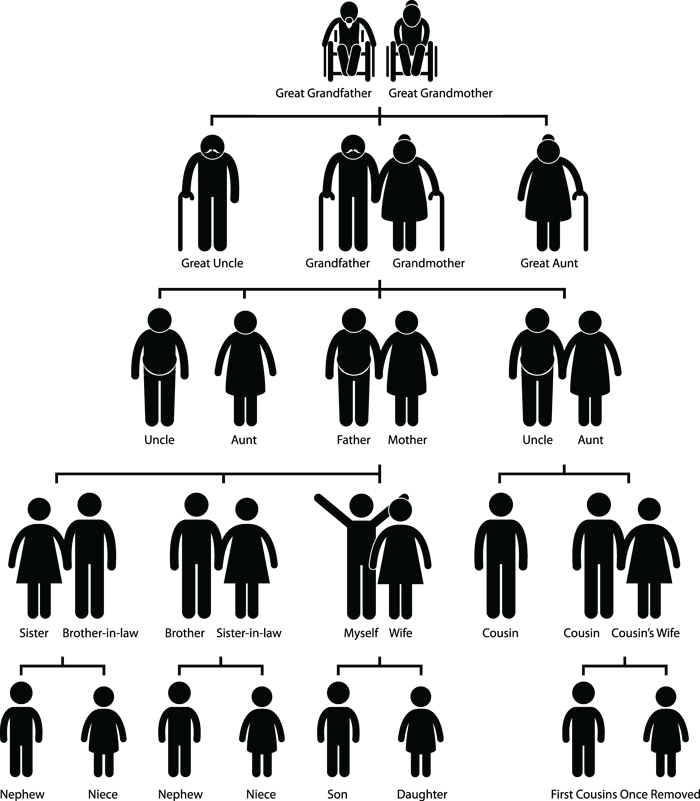

Click to find out who inherits from the estate of an intestate person

Click to find out who inherits from the estate of an intestate person

An Intestacy Example : No will with wife and children

A husband dies leaving an estate worth £650,000 and a wife (or civil partner) and two children. The wife receives the personal possessions (sometimes called chattels) and £250,000 outright. The balance of £400,000 is split 50/50, so £200,000 going to the wife (for which she will only benefit from the interest of) and the other half going to their 2 children.

An Intestacy Example : No will with wife and no children and parents

If the intestate person died leaving a spouse but no children or grandchildren but the parents of the deceased are still alive, then the spouse or civil partner gets the chattels and a statutory legacy and half of the remainder outright. The parents get the other half of the remainder outright but if they have not survived the deceased but the deceased had left sisters or brothers they will share the other half of the remainder.

Need help with a intestate dispute?

When a person dies intestate it can leave many relatives with an expectation that they are due to inherit from the estate. Intestacy Rules are there to handle these disputes. If you need help please get in touch for a fixed fee quote from our Wills & Probate specialists.