Mortgage rates fall along with house prices

- Bank of England increases base rate to 5.25% for the 14th time in a row

- Lowest sales volume for March since 2009 (post financial crash)

- House prices in England & Wales up by 2% on last year

- House prices in London up by 1%

- Property Mark report "The supply of new homes up for sale per member branch continued to lessen in June—now at eight per member branch".

- Mortgage approvals for home buyers down 13% YOY for June 2023

As the Bank of England (BOE) increase the base rate for the 14th time in a row to 5.25% the housing market is struggling with a lack of sellers coming to market. Even with house prices starting to fall month on month and mortgage lenders offering more 2 and 5 year fixed rate deals, this isn't enough to help first time buyers onto the ladder or home movers to upsize.

According to Taylor Wimpey, the proportion of first-time buyers taking out mortgages with a term of more than 36 years nearly quadrupled in the first half of this year. The housebuilder said that customers were taking out longer mortgages to make monthly repayments more affordable. For obvious reasons: to make the monthly mortgage repayments affordable based on their income and spending.

The challenge for buyers is the interest rate being applied to 5 year fixed deals. According to data from Moneyfacts, the average five-year fixed mortgage deal in the UK now has an interest rate of more than six per cent. Paying 6% interest on a 36 year mortgage of £250,000 will mean £1,413.94 in mortgage repayments each month. In contrast, 12 months ago, at 2% interest, the monthly payment would have been just £812.

Will the BOE base rate go any higher?

Whilst interest rates have been so low, mortgage lending has been more affordable. Now that rates are going up we are seeing fewer mortgages and for first time buyers, 36+ year terms may be the only way to make buying affordable.

At SAM Conveyancing we have a lot of first time buyers who've secured mortgage offers based on June rates, who are telling us they must complete before their offer expires because they won't be able to afford the mortgage based on the new interest rates. This creates high pressure within the transaction, especially if the property being bought has issues which could cost them thousands in the future. This will push some buyers into choosing to buy a property they probably shouldn't, rather than pulling out and waiting for a better one. Sadly the heart often overrides the mind; even when we try to rationalise the choice.

I predict the BOE base rate to go up to 6% by October 2023, says Andrew Boast FMAAT

For those holding off in the hope for lower rates, the best advice is to secure the best rate now for a 2 year fixed term. Base rate is going up again and won't drop as quickly as you may think. This has been confirmed by a statement from the Bank of England who said "it would not cut interest rates until there is “solid evidence” that inflation is falling".Sales volume lowest since the 2009 crash

London

The number of completed property sales for the month of March picked up on on month by 11% but is still down 39% on last year. Whilst many lenders and media outlets state property prices are falling, they still remain 1% up on last year and only a 1% fall month on month. With no volume of fresh property the house prices in the capital will continue to fall only slightly.England & Wales

England and Wales echoes London with an 8% increase in sales volume but a 39% fall year on year. The lack of affordable mortgage products, followed by a fall in available properties and the overall uncertainty in the housing market is going to cause the market to slow down. Buyers will be thinking why get a 6% mortgage rate this year when you can get a 4-5% deal in the Spring.Mortgage approvals rally

Bank of England data shows that mortgage lending to purchase property increased month on month to 54,662 which could be linked to the mortgage lenders offering more 2 to 5 year fixed rate deals. However, this is the lowest number of approvals for June in 10 years and is a fall of 13% year on year.At SAM Conveyancing we are seeing a considerable fall in buy to let landlords entering the market and with first time buyers being priced out and second home movers sitting tight, the market will slow down over the next 2 to 3 months. The slow down will start to ease from January 2024 onward after the base rate has stayed static for a number of months.

What about the remortgage market?

Remortgages were up month on month by 13% but still falling by 11% year on year. This could be linked to more buyers in 2018-2022 securing longer term mortgages with a low fixed rate, however those exiting these rates may have to sit tight as they won't be able to afford to remortgage.Housing supply never meets demand

The government have stated for the last 10 years that we need 300,000 new homes to meet with the demand, however as you can see below, the target has never been reached. This inflates house prices because without enough fresh housing stock and with not enough home owners selling the average house price will remain higher; especially for new builds where you pay a premium (just like buying a new car).

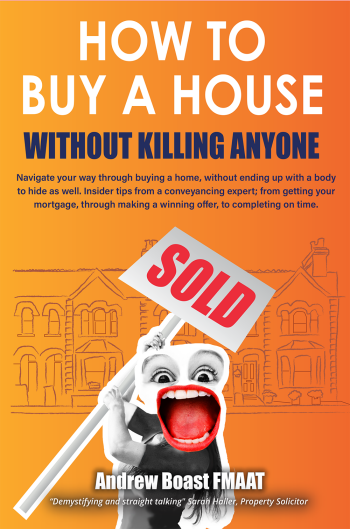

Andrew Boast FMAAT

CEO of SAM Conveyancing

Without Killing Anyone

This book could be the difference between every mover’s dream, buying and moving into your new home stress free, or, stress, missed deadlines, legal disasters, building defects, and possibly the collapse of the whole transaction. (Costing you a small fortune, a head full of grey hairs, and, driving you to threaten the life of your solicitor, lender, co-owners, family, partner, or some combination of all five).

With more than two decades’ experience in the conveyancing sector and over 50,000 successful client moves under his belt, Andrew shares insider tips and advice to empower you as a buyer, giving you the tools to make the best decisions for your circumstances and ease the chaos.

Available on Amazon | Kindle | Paperback