What is Shared Ownership?

- Shared ownership properties offer an affordable way for lower-income earners to buy a property through co-owning with a landlord or housing association.

- Top Tip: Make sure to compare offers from multiple mortgage brokers to get the best deal for you.

- Shared ownership rents are reviewed annually and can increase based on the Retail Price Index plus 0.5%.

If you're thinking about buying a home, but the price tags out there are making you feel dizzy, try shared ownership – the affordable way to get your foot on the property ladder without having to buy the whole house upfront. But what exactly is shared ownership, what are the positives and negatives, and how does it work? Let’s break it down.

What does shared ownership mean?

The shared ownership scheme allows lower-income earners to buy a property with a smaller deposit by co-owning with a housing association. It’s designed to help those who can’t afford to buy a home outright.

The shared ownership scheme involves a shared ownership lease, which outlines the rights and responsibilities of the leaseholder.

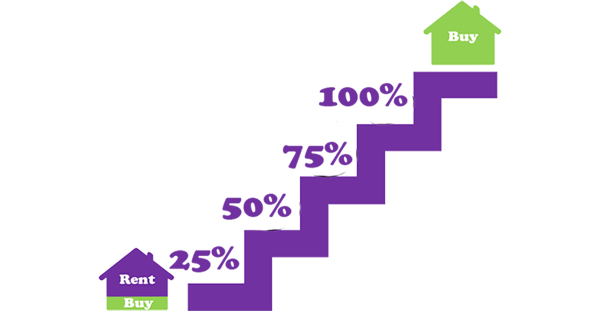

You buy an initial share of your property, usually between 25% to 75% of the full property value, and the housing association keeps ownership of the rest. For the share that you don’t own, you pay a monthly rent to the housing association.

The Discount Market Sale scheme is similar, but you don't have to pay rent on the share which is discounted (because it's held by the housing association).

The shared ownership property will either be a new build or an existing shared ownership property being sold as a 're-sale' through the housing association. You'd buy your initial share via a deposit and a shared ownership mortgage.

Once you own your first share, you can look to buy a greater share over time - this is called staircasing. If you have a long-term disability, you can use the HOLD Shared Ownership Scheme for Disabled People

Are all shared ownership properties leasehold?

Yes, all shared ownership properties are leasehold. This means you have a lease from the housing association or developer to live in the property for a certain number of years, typically 99 or 125 years.

Shared ownership leases govern the relationship with the landlord and outline the responsibilities of the leaseholder, including getting a mortgage, paying rent, and maintaining the home.

Leasehold ownership involves paying ground rent and possibly service charges for the maintenance of communal areas. While this might sound a bit daunting, it’s quite standard for flats and new builds.

Looking to instruct a solicitor for your shared ownership home purchase?

Get a fixed-fee no-obligation quote today for your property purchase. You’re also protected by our no sale no fee guarantee.

How does shared ownership work?

When you buy a shared ownership property, you’ll purchase a share of the home and pay rent on the part you don’t own. Over time, you can buy more shares in the property, a process known as “staircasing,” until you eventually own 100% of the property, if you wish.

Initial purchase: You start by buying a share of between 25% and 75% of the property’s market value.

Rent: You pay a reduced rent on the remaining share owned by the housing association.

Staircasing: You can buy additional shares in the property in the future, often in increments of 1% or 5% and more.

Final ownership: If you staircase to 100%, you become the outright owner and no longer pay rent.

If you were to buy a 25% share of a property worth £180,000 (£45,000) with a £5,000 deposit, it would require you to get a mortgage for the £40,000.

The remaining balance of £135,000 is owned by the Housing Association, and you pay monthly rent on this. This is normally at a rate of 2-3% per annum; in this example, the rent for the year could be up to £4,050, which equates to £337 per month.

Stamp Duty Land Tax (SDLT): When purchasing a share in a shared ownership property, you have the option to pay stamp duty on the full market value of the property upfront or only on the portion being bought.

This decision can impact future staircasing or purchasing additional shares. First-time buyers have different considerations to pay stamp duty.

What is a shared ownership mortgage?

A shared ownership mortgage is a special type of mortgage designed for buying a share in a shared ownership property.

Unlike traditional mortgages, you only need a mortgage for the share you are buying, not the full market value of the property. Many lenders offer shared ownership mortgages, and they typically have lower deposit requirements compared to standard mortgages (a 5% deposit is typically enough).

It's essential to compare offers from multiple high-street banks and building societies to get the best deal for you. These mortgages often come with competitive interest rates too, but terms and conditions can vary from lender to lender.

For example, if you are buying a 25% share of a £200,000 property, your share will be £50,000 and therefore the deposit would be £2,500.

Looking for a shared ownership mortgage?

Our independent mortgage brokers can give you the best chance of success in getting a mortgage offer from mortgage lenders.

How is rent calculated?

The shared ownership rent you pay on the share of the property you don’t own is typically set at around 2.75% of the property value per year. For example, if the unowned share of the property is valued at £150,000, your annual rent would be around £4,125, or approximately £344 per month.

Shared ownership rents are reviewed annually and can increase based on the Retail Price Index plus 0.5%.

Shared ownership can be a fantastic way to get onto the property ladder, especially if buying outright seems out of reach.

Pros and cons of shared ownership

Pros of a shared ownership property

- Appreciation in value - you get to own something even though you're paying rent, and can potentially benefit from an appreciation in the full market value. Your share in the property will increase in value proportionally.

- Affordability - buy with a much smaller deposit - just 10% of your initial premium, and apply for a smaller mortgage. This is much more affordable for first-time buyers.

- Flexibility - you can staircase to own more and pay less rent, eventually owning the property outright. Unlike private renting, shared ownership can provide more security and stability.

- Reduced rent - the rent is often cheaper than private renting.

Cons of a shared ownership property

- Conveyancing is more expensive and takes longer than normal.

- Leasehold fees - you have to pay ground rent and service charges.

- There is an added risk of eviction as a tenant as well as repossession.

- Staircasing is costly - each time you buy a share, you'll have to pay legal and valuation fees which can become a financial burden.

- Limited market - it may be more difficult to sell than a fully owned home and you'll need to buy a shared ownership valuation. You'd also need to find a shared ownership buyer who qualifies for the scheme if you go down the open market route. However, your housing association will try to sell the property first before allowing you to take it to the open market.

What are the eligibility rules?

Eligibility for shared ownership schemes is determined by specific criteria set to help those who need it most. Here’s a detailed look at these rules:

Income cap: Your annual household income must be less than £80,000 per year (or £90,000 in London). This cap is put in place to ensure that the scheme is targeted at those who might otherwise struggle to afford a home.

First-time buyer or relocating: Typically, shared ownership is aimed at first-time buyers or those who used to own a home but can't afford to buy one now.

Local criteria: Some properties may have additional criteria based on local housing needs, such as priority for people living or working in the area.

Housing need: Priority is often given to people who are already renting a council or housing association property, or to those on a local authority housing waiting list.

Credit history: You'll need to have a good credit history and demonstrate that you can afford the monthly mortgage repayments, the rent, and any service charges from the lease agreement.

How do you apply for shared ownership?

Applying for shared ownership is a multi-step process, but it’s pretty straightforward once you know what to expect.

Start your property search

Most online property portals and housing associations, including Rightmove and Zoopla, have a shared ownership section. You'll be able to search by:

- Re-sale or new build.

- The rent you have to pay.

- Property price.

- Location.

Check the eligibility criteria

Make sure that you meet the eligibility criteria for the property and the area.

Apply and get a financial assessment from the housing association

Complete an application with the housing association and then undergo a financial assessment to determine the share you can afford to buy.

Mortgage approval

Arrange your shared ownership mortgage to finance your share.

Shared ownership scheme for particular needs?

There are special shared ownership schemes for:

People with disabilities

Home Ownership for People with Long-Term Disabilities (HOLD). You can buy any property for sale on a shared ownership basis.

Older people

Older Person's Shared Ownership (OPSO). It is for people aged 55 or over and works in the same way as the general shared ownership except you can only ever own a maximum of 75% of your property.

Andrew started his career in 2000 working within conveyancing solicitor firms and grew hands-on knowledge of a wide variety of conveyancing challenges and solutions. After helping in excess of 50,000 clients in his career, he uses all this experience within his article writing for SAM, mainstream media and his self published book How to Buy a House Without Killing Anyone.

Caragh is an excellent writer and copy editor of books, news articles and editorials. She has written extensively for SAM for a variety of conveyancing, survey, property law and mortgage-related articles.