We were delighted to hear about the launch of the Help to Buy ISA when George Osbourne announced it in the House of Commons. Its stated purpose was "to tackle the biggest challenges facing first time buyers; the low interest rates when you build up your savings and the high deposits required by the banks". The scheme allows first time buyers to get a 25% bonus on top of their savings and to benefit from tax free interest. This is an excellent idea with great intentions as rising property prices drive up deposit sums required. As it stands, home ownership is at an all-time 30-year low with only 63% of people living in a home they own - the Help to Buy ISA was brought in to tackle this.

Banks and building societies signed up to provide ISA accounts and actively promoted saving for a deposit:

- "Great for saving for a bigger deposit" Natwest Bank

- "Help save for a bigger deposit" Halifax PLC

- "Saving up for a deposit for your first home" HSBC Bank PLC

After the scheme went live, first time buyers jumped at the opportunity with 500,000 accounts opened in the first 8 months; all hoping to save for the deposit for their first home.

Sadly the Help to Buy ISA held a hidden truth that only came to light following our due diligence for a client who was looking to use her and her boyfriend's ISA to fund their deposit.

Here is how we uncovered the truth behind the Help to Buy ISA and helped our client use their ISA to buy their first home.

Wednesday, 17th August 2016

We first found the issue with the Help to Buy ISA following an enquiry from our client, Gemma. She was buying her first home with her boyfriend and they had both saved £2,000 in a Help to Buy ISA which would mean they could benefit from a £1,000 bonus. Gemma asked when she should cash in her Help to Buy ISA as she wanted to tie it into

exchange of contracts .

When looking into the small print on helptobuy.gov.uk we found this statement:

"The Help to Buy: ISA bonus must be claimed on your behalf by a solicitor or conveyancer in anticipation of the completion date. The bonus must be included with the funds consolidated at the completion of the property transaction. The bonus cannot be used for the deposit due at the exchange of contracts, to pay for solicitor’s, estate agent’s fees or any other indirect costs associated with buying a home."

The more detailed clause is in the Help to Buy ISA Scheme Rules which states:

"An Eligible Conveyancer shall only be entitled to apply a Bonus that it has received from the Administrator towards the purchase of an Eligible Interest in Land by the relevant Help to Buy: ISA Holder who will, in connection with such purchase, become a First Time Buyer. Until the time that an Eligible Conveyancer applies a Bonus (paid by the Administrator into its Client Account in accordance with clause 7.6(B)(i)) (Payment of the Bonus) towards such a purchase, the Bonus shall remain the property of HM Treasury."

The definition of an Eligible Interest is: "a legal interest in land, solely or jointly owned, and situated within the United Kingdom, as described in paragraphs (a) and (b) of the definition of Residential Property Owner."

The definition of Purchase Price is: "(a) in connection with the acquisition of any interest in land other than under the terms of a Regulated Home Purchase Plan, the value of the consideration required to be paid, and which is paid, by the purchaser under the sale and purchase agreement entered into in connection with the acquisition of that interest in land (excluding, for the avoidance of doubt, any consideration attributed to the purchase of any fixtures and/or fittings); and

(b) in connection with the acquisition of any interest in land under the terms of a Regulated Home Purchase Plan, the value of the consideration required to be paid, and which is paid, to the original seller for the legal interest in that land (excluding, for the avoidance of doubt, any consideration attributed to the purchase of any fixtures and/or fittings)."

We were shocked as it was clear from the rules that you can only use the bonus to pay for part of the Purchase Price (of the land) on completion and not for the deposit on exchange, or for the costs of buying such as stamp duty or legal costs.

What's the problem?

Although you could use the bonus on completion, how can you use a bonus to part purchase an interest in land when the exchange deposit is 10% and the mortgage is 90%? In this scenario the purchase price is completely covered already before you can apply the bonus. This affects any first time buyers who have a 90% loan to value (or a 75% loan to value if buying using the Help to Buy Equity Loan scheme) because if there is more equity invested in the property (80% loan to value), then the bonus can be used to buy part of the property (the bit between the 10% deposit and the 80% mortgage).

Sadly this meant Gemma wasn't able to use her bonus to help fund her deposit and when we told her she was equally shocked that the Government and the banks had been stating that the ISA was to help you get a bigger deposit. She couldn't even use the bonus on completion as she was getting a mortgage to pay off the balance - a double blow which she had no idea about.

On the same day, another one of our clients was not able to use their Help to Buy ISA bonus at all as they weren't getting a mortgage. This was something they felt wasn't explained to them when they took out their ISA.

The scheme rules were clearly having a negative affect on first time buyers and something needed to be done.

We spoke to some solicitors in the conveyancing sector who:

- didn't know you couldn't use the bonus as a deposit;

- hadn't worked on a Help to Buy ISA yet because of how early on we are into the scheme; or

- had known about the deposit exclusion, however were using the bonus on completion - whether or not they knew it was only able to be used to fund the purchase of land or not.

With all of this confusion we got in contact with the the Treasury who have still not responded to our enquiry to this day...

We needed answers, our clients needed answers, the conveyancing sector needed answers and so we decided to get in contact with Katie Morley at the Telegraph to see if this was a story that they could help break.

Thursday, 18th August 2016

Katie came back to us and wanted to know more. She couldn't believe that a scheme aimed at helping first time buyers get a larger deposit was in fact not allowed to be used to pay for the deposit. We dug even deeper and found even more statements that you could use the ISA to get a larger deposit:

Sir Tony Baldry, 20 March 2015:“Many people also want to own their own home. I very much welcome the fact that first-time buyers will be able to benefit from a new Help to Buy ISA, which will offer a tax-free way of saving to buy their first home. The Treasury estimates that 285,000 first-time buyers will use the scheme every year. Someone who is trying to save a 10% deposit for a £150,000 home will have to save £12,000 and the Government will contribute £3,000, taking the total to £15,000. It is effectively a tax cut for first-time buyers."

10 Feb 2016 : Column 1567 Prime Minister David Cameron: "Housing is the No. 1 issue in my constituency—a workable local plan that looks after our green spaces while offering that pure Conservative value, the right to buy. Does the Prime Minister agree that our Help to Buy ISAs, one of which is currently being taken out every 30 seconds, is the right way to promote savings and encourage home ownership?"

The Prime Minister: " I absolutely agree with my hon. Friend. One of the most difficult things for young people is to get that deposit together for their first flat or their first house . That is where Help to Buy ISAs, where we match some of the money they put in, can make such a difference. Some 250,000 first-time buyers have opened a Help to Buy ISA, so under this Government we have seen 40,000 people exercise the right to buy their council house. Now we are extending that to all housing association tenants, and we have seen 130,000 people with Help to Buy getting their first flat or house. There is more to do—mostly, building houses— but helping people with their deposits is vital for our country. "

Gemma agreed to feature in the article to bring her story to the attention of other first time buyers.

Katie contacted the Treasury to get their side and it was clear that they weren't aware there was an issue. When questioned by Katie on why the bonus could not be used to fund the deposit, the main concern of the Treasury was that buyers could benefit from the bonus on exchange and never actually buy the property.

This didn't make much sense because for buyers, pulling out after exchange of contracts isn't something they would want to do, or benefit from as they forfeit their whole 10% deposit. The 10% deposit is mainly made up of the buyer's savings and the bonus makes up a smaller, but very important, part of this.

The Treasury didn't offer any assurances that they would make any alterations to the Help to Buy ISA scheme rules.

Saturday, 20th August 2016

The story hit front page of the Telegraph and was quickly redistributed via the Daily Mail, The Sun, The Independent, Metro and The Times.

Ronke Phillips of ITV interviewed our Co-founder, Andrew Boast, for his opinion on what the Government needed to do to address the issue with the Help to Buy ISA scheme.

Tuesday, 22nd August 2016

Wednesday, 23rd August 2016

In the morning we wrote to Philip Hammond, Chancellor of the Exchequer, to put forward our feelings and suggestions in relation to the Help to Buy ISA bonus not being allowed to be used as a deposit. You can read our letter in full on the right, however we focus on the main issue that the Treasury is concerned that first time buyers will pull out after exchange. As the buyers never actually receive the bonus as it is paid to their solicitor, and the deposit is forfeit after exchange of contracts, then their main concern is unlikely to ever happen.

Later that afternoon, Mr Tyrie, chairman of the Treasury select committee, made a statement to the

Financial Times acknowledging that

"it looks as if the fine print may have unintended consequences for first time buyers".

Thursday, 24th August 2016

BBC's Winifred Robinson interviewed us on her Radio 4 show, You and Yours about how the Help to Buy ISA has affected our clients.

Wednesday, 30th August 2016

Katie Morley contacted us after being told that two first time buyers had been informed by their solicitors that they could not use their Help to Buy Bonus for their shared ownership property as the "value of the property" was over £250,000 which is an exclusion, for properties outside of London, within the terms of the Help to Buy ISA scheme.

At first when we reviewed the Help to Buy ISA Scheme Rules we found that the definition of the "Value of the Property" seemed to conflict with the one found in the Conveyancing Guidelines used by conveyancers when looking at shared ownership.

The Help to Buy ISA scheme rules define the "Purchase Price" as "the value of the consideration required to be paid", but the Conveyancing Guidelines state: "The Eligible Conveyancer is also required to verify that the Help to Buy: ISA holder is acquiring an Eligible Interest in land, that the acquisition is funded by a non-buy-to-let mortgage (unless exceptions apply) and that the value of the property is up to £250,000 or £450,000 depending on the location of that property (see clause 7.5(A) – (C) of the Scheme Rules)."

This appeared to be confusing conveyancers as the value of a shared ownership property is different to the consideration paid by the client. We believe this is an area that requires further clarification, although we do note that the Conveyancing Guidelines refer to 7.5(A)-(C) of the Scheme Rules which state: "the Purchase Price for the Eligible Interest in Land is: (1) if the Eligible Interest in Land is situated in London, not more than £450,000; or (2) if the Eligible Interest in Land is situated outside London, not more than £250,000."

As the definition of the "Purchase Price" is the value of the consideration required to be paid then it can be assumed that as long as the consideration being paid is less than £250,000 outside London and £450,000 inside London, then in our opinion the bonus can be used to fund part of the Purchase Price on completion even if the value of the property is higher.

Friday, 16th September 2016

In the wake of our letter, the Government appeared to back down with the Treasury announcing that Help to Buy ISA savers could transfer funds into a new

Lifetime ISA from April 2017 and critically could then put the ISA bonuses towards home deposits at the point of exchange. (Please visit our

Press area to view the article.)

Many commentators expressed that the Treasury's move was a step in the right direction but criticised it for falling short of amending the original Help to Buy ISA rules for the 500,000 savers already signed up, urging it to carry out this action.

Delays, hassle...

At present, you can't use funds saved into a Lifetime ISA for a year after you've opened it, so effectively savers won't be able to put bonuses towards

exchange deposits for at least another

18 months. You also have to go through the palaver of switching between accounts.

Conservative MP and prominent Treasury select committee member Jacob Rees-Mogg commented on the Treasury's action:

"The Treasury has been reluctant to publicly admit this mistake and would have been better just admitting it earlier. Now they have tried to fix it by allowing people to transfer into Lifetime Isas. They should just cut out the middle step and amend the Help to Buy Isa."

The reversal has not bolstered the Treasury's claim it could not allow Help to Buy ISA bonuses for exchange deposits because people might fraudulently siphon off the bonuses without completing the purchase of a home. The Treasury also previously referred to 'administrative difficulties' which also seem to have magically disappeared regarding the Lifetime ISA.

Sector experts also poured doubt on the Government's statements regarding fraud. They have stated there is no difference in the risk of fraud for either type of ISA.

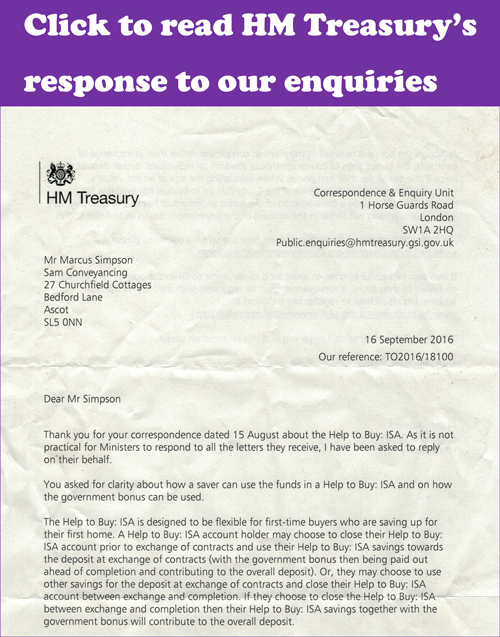

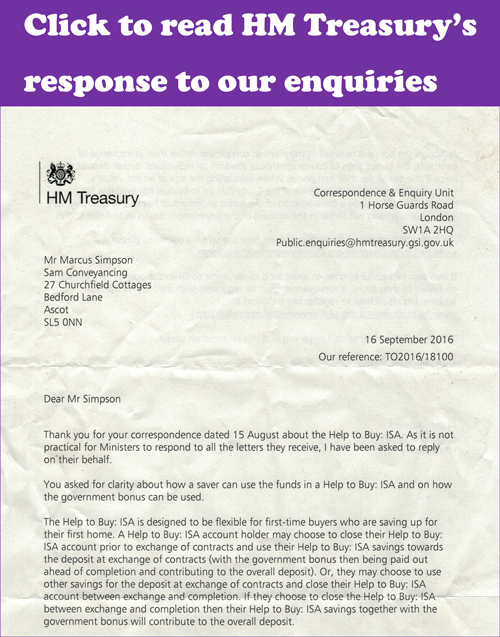

Response to our initial query to the Treasury

On this day, we also finally received a response from the Treasury to our request for information about Help to Buy ISAs which we'd originally emailed

![]()

through 15 August. Of some reassurance was the following statement:

"When calculating the size of an individual's mortgage, lenders will seek evidence of the funds that an individual has available for a deposit. This will include a consideration of the funds an individual has in a Help to Buy: ISA account and lenders will factor in the amount of the government bonus in addition to this."

So it appears that finally the Government has released a statement that puts the onus on lenders to factor in the future receipt of any Help to Buy ISA bonus funds from a client which will be available on completion, a highly significant matter. You can read the full text of the response by clicking on the button on the picture above.

Monthly payments and compounded interest

The Treasury also announced that bonus funds would be paid into savers' accounts every month rather than yearly, so they could benefit from compound interest.

90 day limit

The Treasury also announced that should a home purchase not be completed within 90 days, conveyancers would then have to return bonus funds to the ISA provider or HMRC would pursue them to recover the monies.

We have argued from early on that the Government should have/should rewrite the Help to Buy ISA rules with just such a claw-back clause but one that allows the bonus funds to be available for the exchange deposit. This option remains open to it and would certainly simplify matters.

exchange deposits for at least another 18 months. You also have to go through the palaver of switching between accounts.

exchange deposits for at least another 18 months. You also have to go through the palaver of switching between accounts.