Thinking of using Heylo Shared Ownership?

You are always required to get a RICS property valuation for your dwelling at the start. Our organisation offers a countrywide, reliable RICS valuation service with great availability and fast delivery of reports.

NB Although Heylo only require a RICS valuation, you are allowed to present the valuation which forms a part of the

RICS HomeBuyer Report; this latter report means you get a full defect survey of the property as well, which may highlight any suspicions your surveyor has of any

property defects.

RICS Surveyors – Local Knowledge – Same Week Availability

Heylo Housing shared ownership offers first time buyers and home movers a version of

shared ownership (part buy, part rent) where they can buy a property

without a mortgage and where clients buy either an existing property (via its

Your Home scheme) or a new build (via its

Home Reach scheme). Additionally, when you come to sell up, Heylo allows you take

75% of the value of any increase of the property for the share which you didn't own. If you live with a long term disability,

HOLD Shared Ownership Scheme may be more suitable for you.

This article examines:

To be considered by Heylo Housing for buying either an existing home or a new build, you need to:

- Have a minimum deposit of 10% of the selling price of the property

- Have 'good credit'

- Have a household income* below £80,000 (£90,000 inside London)**

- Be able to satisfy 'typical affordability criteria' such that it's clear you can afford the home you wish to buy, all outgoings considered

- Be in permanent employment, have pension income or similar

- Be a British or EU citizen or have indefinite right to remain in the UK

- Not have been bankrupt or have any outstanding bad credit such as CCJs

Additionally:

- On the day of purchase, with the Your Home scheme, Heylo has to have an investment of at least £100,000 of the unpurchased property value; but NB if the full value of the property is less than £100,000 then Heylo has to have a minimum 50% of the property's value.

- On completion, the property you're buying must be your main and only residence, although you can be a property owner at the time you apply.

- You cannot use the scheme as an investor or if you are looking to buy to let.

For the Your Home scheme (existing property), the property must:

- Be of traditional construction;

- Be immediately inhabitable and of good habitable condition;

- Be second hand (at least one year old and have been lived in);

- In either England or Wales;

- Not be sold at auction; and

If you want a brand new home, you should use the Home Reach scheme.

*Household incomes can be derived from employment, self employment, pensions and maintenance payments including Tax Credits and benefits.

Heylo's marketing information states that clients are likely to need at least £4,000 and possibly as much as £6,000, depending on the stamp duty you are liable to pay, set aside to cover costs.

Once you've registered with Heylo Housing and have been accepted by them to proceed, these are the ongoing and continuing costs involved:

RICS Valuation

Under the Your Home scheme, you are only required to get a basic RICS valuation to establish the value of your property, however for your own peace of mind, you may wish to get more in-depth defect survey such as a RICS HomeBuyers Report.

RICS Valuation or RICS HomeBuyer Report?

NB As stated above, although Heylo only require a RICS valuation, you are allowed to present the valuation which forms a part of the RICS HomeBuyer Report and this latter report means you get a full defect survey of the property as well, which may highlight any suspicions your surveyor has of any property defects.

We always advise home buyers to get a

Home Buyer Survey which checks out a property for issues; if suspicions are found, you can then check them out further and, depending on the results, bargain with your vendor for a price reduction or even pull out entirely if the costs of remedy look to be too great.

RICS HomeBuyer Reports are slightly more expensive than RICS valuations however you get a full, independent property defect survey and also have the valuation (which Heylo requires) as well as a reinstatement cost estimation included in the price.

As stated previously, we offer RICS Heylo Housing valuations and RICS HomeBuyer Reports and RICS Building Surveys; click on the link above or call 0333 344 3234 for a free quote.

Conveyancing

You have to instruct conveyancing solicitors to carry out your conveyancing with Heylo on your behalf.

Heylo offer their own panel of solicitors for this purpose, picked because of their wealth of experience with, and understanding of, shared ownership.

Property Searches

Heylo Housing require you to buy your required property searches (click to find out more) through them and charge you 'in the region of £500'. The exact price can vary as it is calculated on an individual property basis.

Product fee

These are fixed at £1,200 (incl VAT) for freehold properties and £1,800 (incl VAT) for leasehold properties for either scheme.

In the case of new builds, this covers Heylo Housing's affordability assessment, application processing and legal fees for setting up your contract.

In the case of existing properties, this also covers the cost Heylo Housing incurs when buying the property you've selected.

Are you buying a freehold or a leasehold with Heylo Housing?

You are actually buying a special long leasehold - for 999 years - unless or until you buy the full 100% of your property, when you can covert it to a full freehold contract. Heylo call this shared ownership lease a 'virtual freehold'.

Minimum 10% deposit on exchange

You have pay a minimum 10% of the selling price of the property as a deposit on the point of exchange. You can opt to buy a larger percentage of the property at the outset; in this case, you pay the remainder (minus the 10% you've paid at exchange) at the point of completion.

On completion, Heylo purchases 100% of your property and sells you your share at the same time.

Rent on completion

You have to pay your first instalment of your monthly rent at the point of completion - this is the rent for the portion of your property which you do not own. You must pay the rent covering the time between your completion day and the end of that month PLUS the next full month.

This rent is charged at 4.89% of the value of the remaining portion you don't own and this increases with the Retail Price Index (RPI) plus 0.75% each year. If RPI is zero or negative your rent will increase by 0.75%.

Note that payments on your landlord's share are linked to inflation (not interest rates) and Heylo Housing claims that this means they should more closely match your household income over the medium and long term.

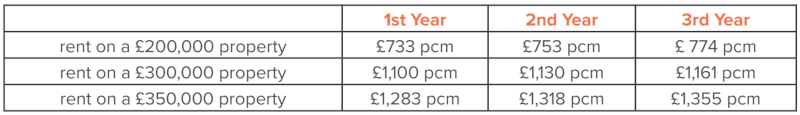

How the rent might increase each year (based on 2% inflation and a 10% deposit:

What stamp duty is payable on Heylo shared ownership?

The normal shared ownership rules regarding stamp duty do not apply to Heylo's leases which are considered to be standard leases (i.e. not shared ownership leases), however they are always new leases, which means that the amount of tax you have to pay is made up from the premium (i.e. the value of the portion of the property you're buying) and the rent you pay (which is discussed in this article).

Please consult Heylo for more information about this.

Buildings Insurance

You have to pay Heylo Housing £120 per year for this (at the time of going to press), this is payable monthly in advance.

Administration charges

Under the Your Home scheme you are charged £16.02 monthly in administration fees which will have been included in the rental figure given to you.

Under the Home Reach scheme you are charged £18.60 monthly in administration fees which will have been included in the rental figure given to you.

Management company service charges (only if applicable)

For certain properties, if there is an existing management company which looks after them and charges service fees for doing so, then Heylo Housing passes these charges directly onto you.

Heylo Housing recommend that, in addition to your deposit funds, you have at least £4,000 and possibly as much as £6,000, depending on the stamp duty you are liable to pay, set aside to cover costs.

'Your Home' scheme - how is your house owned?

You own the property you buy via 'Your Home' on a shared ownership lease, which is 999 years (the term of a 'virtual freehold') - this is considerably more generous than you would get with any other type of shared ownership lease. The lease sets out your rights to occupation as a customer as well as your obligations as a home owner.

NB You can only have a maximum of 2 people on a 'Your Home' lease (there's a maximum of 2 applicants per purchase) although you do not need to be related in any way.

Yes you can. You have to have funds for the minimum 10% deposit required but you can also use mortgage funds to enable you to buy a larger initial share of your property.

4How does Heylo Housing staircasing work (buying a larger percentage share at some point after your initial purchase)?

You can buy a larger percentage share of your property at any point and benefit from having to pay a lesser rent as a result.

Heylo incentivise this by, in the case of your property having risen in value when you come to staircase, giving you 75% of any rise in value via a discount.

- Unlike standard shared ownership, you have to pay a minimum full 10% deposit on the whole of the purchase price. This compares to a much smaller deposit of 10% of the percentage share you are buying for standard shared ownership.

- For the new build scheme ("Home Reach"), you are restricted to buying new builds which are sold at a discount to prevailing market rates for an area and from organisations which have established a relationship with Heylo Housing.

There are other nuances which accompany shared ownership in general such as the fact that the accompanying conveyancing, whether for the initial purchase or for subsequent staircasing, is more expensive than for normal purchases.

- Apply to Heylo Housing who give you a decision in principle, (effectively this details Heylo as a cash buyer for the entire purchase price you've proposed).

- You use the Your Home scheme if you wish to buy an existing property on the open market and negotiate with the estate agent or vendor. Once your offer has been accepted, you should instruct your solicitor, then you contact Heylo, book your RICS valuation (or RICS HomeBuyer Report - see above) and pay your £1,200 product fee.

- You use the Home Reach scheme to buy a new build, you find your discounted property (must be minimum 25% discount from prevailing market prices) by consulting Heylo about eligible properties in the area you wish to buy in - you may also find that new build developers themselves advertise that they're working with Heylo) then put in your offer and negotiate with the developer over price. Once your offer has been accepted, you should instruct your solicitor, then you contact Heylo, book your RICS valuation and pay over your £1,200 product fee.

Once you've instructed your solicitor and have your conveyancing up and running, things follow the normal

conveyancing process.

Regarding new builds, when you purchase, the Local Authority or developer places a restriction on the title of the property to ensure that the original 25% discount is recovered if the property is sold outright but this does not affect your rights to buy a bigger share or buy the property outright - it simply determines who gets the money when you do.)

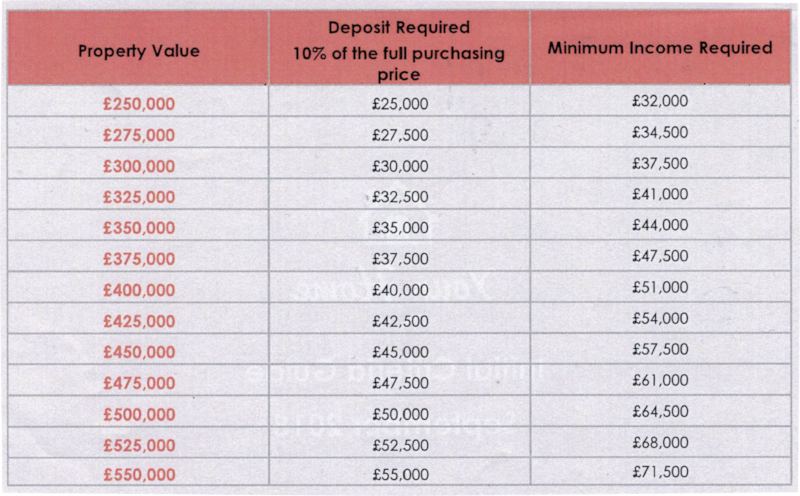

'Your Home' - property values vs deposits required vs minimum income required: