| London | England and Wales |

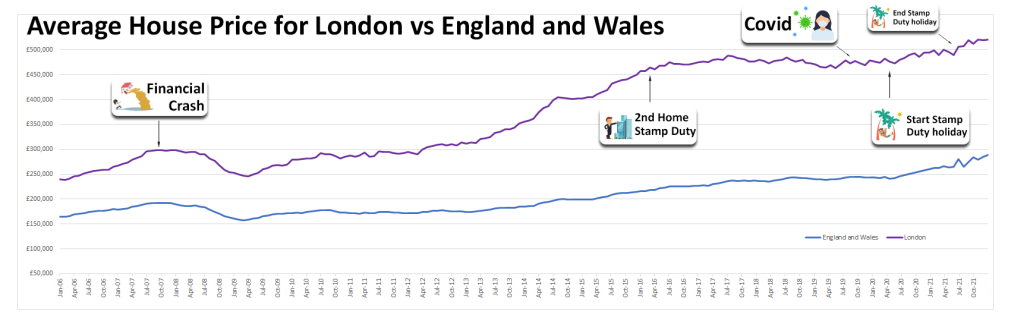

Average House Price Most recent Land Registry data Dec 2020 | £521,146 Up 6% YOY (record high) | £288,498 Up 11% YOY (record high) |

Average Sales Volume Most recent Land Registry data March 2020 | 1,993 Down 75% YOY | 24,659 Down 70% YOY |

Headlines for February 2022

- In January, 78 per cent of properties sold by Propertymark member agents went for the asking price or above

- Mortgage approvals for home buyers up 34% YOY (England and Wales)

- Number of sales made to FTBs fell to 29% in January 2022 (England and Wales)

- Number of house hunters per estate agent branch rose from 379 in June to 428 in July (England and Wales)

- Average annual salary increases to £39,863

London's Sales Volume Hits Record Low

After an exhausting record high number of sales in June 2021 following the

end of the SDLT holiday, London falls to a record low number of sales of

1.993 in October 2021. Previous October volumes were 8,063 (2020) and 7,901 (2019).

London has seen falls like this before, the last being when the 2nd home stamp duty came into force in April 2016. In March there were 17,501 sales as second home buyers looked to buy before the 3% duty kicked in. It fell the following month to 5,746 and only returned to YOY growth one year later.

How did the rest of England and Wales do?

England and Wales saw volumes hit a record high in June 2021 and fall to a record low of 24,659 in October 2021. The volume is lower than those seen during the Financial Crash in 2017 when it fell to 26,954 in Jan 2009.

Record House Prices in London

Although the volume is low, the average house price continues to increase to £521,146 in December 2021. The year on year growth has increased every month since December 2019 . England and Wales follows the same trend as it posts a record high of £288,498.

Mortgage Lending is on the Up

Bank of England data shows that mortgage lending to purchase property was up to 71,015 compared to 2019's 67,112. Whilst lower than 2020's 101,238, the previous year was increased based on the stamp duty holiday.

The increase in mortgage lending in December could indicate growth in the housing market.

Summary

The London housing market has stalled post the end of the SDLT holiday however the NAEA reports show signs of demand coming back to the housing market.

The question still stands, How long can the London housing market continue to grow whilst the average sale price is at record highs?